Over the past decade, the demand for ski vacations has surged, with the ski and snowboard industry growing by approximately 3.6% per year since 2014. This rising trend not only highlights the increasing popularity of winter sports but also underscores the growing interest in ski properties as vacation homes and investment opportunities.

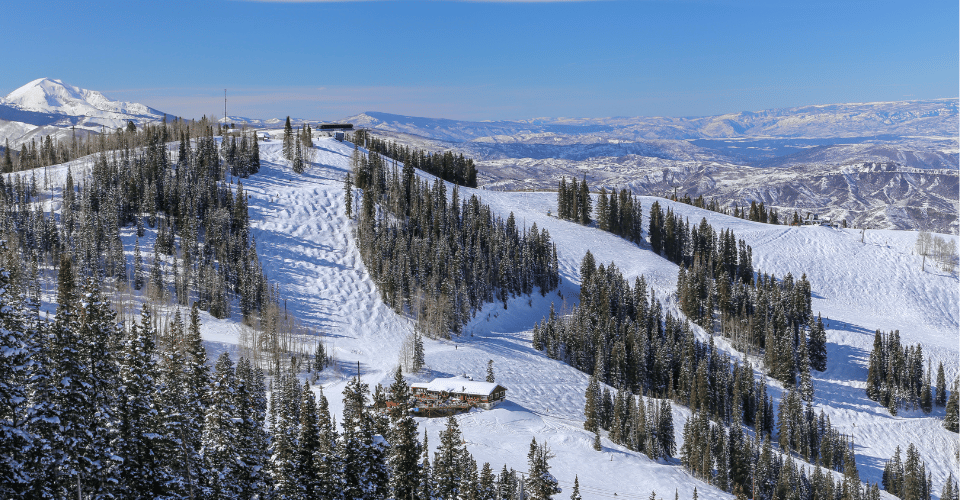

Ski properties offer a unique allure, combining the thrill of winter sports with the charm of scenic, snowy landscapes. They attract a diverse group of investors and vacationers alike, ranging from adventure-seekers to families looking for a cozy getaway.

The appeal is not just in their recreational value but also in their potential as lucrative investments. These properties typically experience high demand during the ski season, which can translate into significant rental income for owners.

Understanding Ski Properties

A ski property is primarily defined as any real estate located in or near a ski resort area, which is used either for residential purposes, vacation stays, or business operations related to ski and winter sports activities. These properties are distinctive due to their proximity to ski slopes and are often designed with features that cater to the needs of winter sports enthusiasts.

Types of Ski Properties

Ski properties come in various forms, each offering unique features and benefits:

- Chalets: These are traditional ski homes made from wood, featuring sloping roofs to prevent the accumulation of snow. Chalets offer a cozy, picturesque accommodation experience, ideal for those looking for a classic ski holiday.

- Condos: Usually part of larger complexes, condos provide a more hands-off property management experience, appealing to investors who prefer minimal day-to-day involvement.

- Commercial Properties: Including lodges and resorts, these properties offer extensive facilities such as dining, entertainment, and on-site ski rentals, catering to tourists and visitors seeking a comprehensive vacation package.

Popular Ski Resort Destinations Known for Their Investment Potential

The investment appeal of ski properties often correlates with the popularity and accessibility of the ski resort. Here are some destinations renowned for their investment potential:

- Aspen, Colorado: Known for its luxury skiing experience and upscale properties, Aspen is a top choice for investors looking for premium rental yields.

- Whistler, British Columbia: Famous for its extensive ski terrain and year-round attractions, Whistler attracts a global audience, boosting its rental demand.

- Jackson Hole, Wyoming: Offering some of the best skiing in the United States with challenging slopes and stunning views, Jackson Hole appeals to a high-end market, providing strong investment opportunities due to its popularity among skiing aficionados.

- Chamonix, France: One of Europe’s most iconic ski destinations, Chamonix maintains robust tourist traffic and a solid investment outlook due to its legendary status in the alpine skiing community.

Investing in ski properties in these renowned areas can be lucrative due to their established markets and continuous influx of tourists. However, investors should also consider local real estate laws, seasonal fluctuations in visitor numbers, and ongoing maintenance costs when evaluating these properties.

Challenges and Considerations

Seasonality and Its Impact on Income Stability

Ski properties are distinctively seasonal, with the bulk of their revenue generated during the winter months. This heavy reliance on a single season can lead to fluctuations in income, making financial planning and management crucial for maintaining stability. Investors need to prepare for off-season periods, potentially by developing summer offerings or improving rental management strategies to attract non-winter guests.

High Initial Investment and Maintenance Costs

Investing in ski properties often involves a high initial capital outlay. In addition to purchasing costs, these properties typically incur higher maintenance expenses due to the need for snow removal, heating, and general upkeep against harsh weather conditions. Prospective investors should carefully evaluate their financial capacity and consider long-term maintenance when calculating potential returns.

Geographical and Climate Risks

Ski properties are susceptible to various geographical and climate-related risks. Avalanches, landslides, and extreme weather conditions can pose significant threats. Seasonal variations also impact snow levels and skiing conditions, which in turn affect visitor numbers. It’s essential for investors to assess these risks and consider insurance and risk mitigation strategies.

Market Saturation and Competition in Popular Ski Areas

Popular ski destinations often face market saturation, with numerous properties competing for a share of the tourist market. This competition can drive up property prices and marketing costs while squeezing profit margins. Investors need to perform thorough market research to identify areas with the best growth potential and less saturation.

Average ROI on Ski Properties in Various Regions

The return on investment (ROI) for ski properties can vary widely depending on the region. For example, premier destinations like Aspen might offer lower yields due to higher property values, while emerging markets may offer higher potential returns at a greater risk. Analyzing the average ROI across different regions helps investors identify where the best opportunities might lie.

Factors Influencing Profitability

The profitability of ski properties is influenced by several key factors:

- Location: Proximity to ski slopes and local amenities significantly affects appeal and rental rates.

- Amenities: High-quality, modern amenities can greatly increase a property’s attractiveness to renters.

- Accessibility: Properties that are easier to reach via major airports or roads tend to attract more visitors and can charge higher rental rates.

Understanding these factors can help investors make informed decisions about where and what type of ski property to invest in, optimizing their chances for a successful and profitable investment.

Market Trends Influencing Ski Property Investments

- How Global Tourism Trends Are Affecting Ski Resorts The global rise in experiential travel has boosted the popularity of ski resorts, with tourists increasingly seeking unique and memorable vacation experiences. This shift has driven demand for ski properties, both for personal use and rental purposes.

- The Impact of Climate Change on Ski Seasons and Property Values Climate change is shortening ski seasons and altering snowfall patterns, which can impact the operational days of ski resorts and, consequently, the revenue generated by ski properties. Properties in regions with reliable snowfall maintain higher values, while those in less predictable areas face greater risks.

- Emerging Ski Markets vs. Established Ski Markets Emerging ski markets, often located in less traditional skiing countries, offer growth potential at lower entry costs compared to established markets. However, established markets like those in the Alps or North America provide stability and consistent demand, albeit at higher property prices.

How to Evaluate a Ski Property Investment

Key Metrics to Consider

Investing in ski properties requires careful consideration of several financial metrics:

- ROI (Return on Investment): Comparing the potential returns relative to the investment cost.

- Occupancy Rates: Higher rates indicate more consistent rental income.

- Operational Costs: These include maintenance, management, and utilities, which can vary widely by location.

Importance of Location and Proximity to Ski Lifts and Other Amenities Location is crucial; properties near ski lifts, restaurants, and other amenities generally attract more renters and command higher prices. Proximity to local attractions and ease of access also significantly influence investment appeal.

Tips for Conducting Thorough Market and Property Research

- Market Analysis: Investigate local market trends, including average property prices, rental rates, and seasonal occupancy.

- Property Inspection: Thoroughly inspect the property for any issues that could affect operations or require costly repairs.

- Consult Local Experts: Engage with real estate agents and other professionals familiar with the ski property market to gather nuanced insights.

Understanding these elements can help investors make informed decisions, maximizing the potential success of their ski property investment.